[ad_1]

Microsoft Corp. isn’t the only U.S. company pointing to the dollar’s surge as a potential problem.

A strong dollar has been a hot topic this week since the software giant

MSFT,

and Salesforce Inc.

CRM,

pointed to challenges the currency is causing for earnings. It’s been flagged in other industries too, including by Pfizer Inc.,

PFE,

eBay Inc.,

EBAY,

and Mastercard

MA,

since foreign sales can be hurt by a strong greenback.

“The strengthening dollar has been a story for a while,” said Dec Mullarkey, SLC Management’s managing director of investment strategy and asset allocation, pointing to the dollar’s DXY recent climb to nearly a 20-year high, as measured against a basket of rival currencies.

“It may be a pinch for companies, but frankly it is good for the Fed,” Mullarkey said.

A strong dollar makes it more expensive for American companies to sell their goods on the international market, which can hurt the stock market. But cheaper imports from a robust dollar help U.S. consumers, the lifeblood of the economy, particularly as households face high costs for gas, groceries and more.

“The strong dollar is helping keep inflation at bay,” Mullarkey said. “That’s critical with energy prices where they are.”

The 2 sides of dollar strength

A hearty dollar also could help the Federal Reserve achieve its “softish” landing for the economy as it works to cool inflation by sharply raising interest rates over the next few months.

“The whole purpose of monetary tightening — draining liquidity — is also to strengthen a currency,” said Ash Alankar, head of global asset allocation at Janus Henderson Investors, by phone.

“The most important battle people have to consider is the Fed fighting inflation,” Alankar said. “At the end of the day, if the Fed can beat inflation, ultimately that’s going to determine whether or not the markets recover.”

The ICE U.S. Dollar index was up 6.5% on the year through Friday, and 13% higher from a year ago, according to FactSet data. The dollar could gain further ground this year if inflation falls at a slower-than-expected pace, said BofA Global analysts in a report Thursday.

A ‘notable market dynamic’

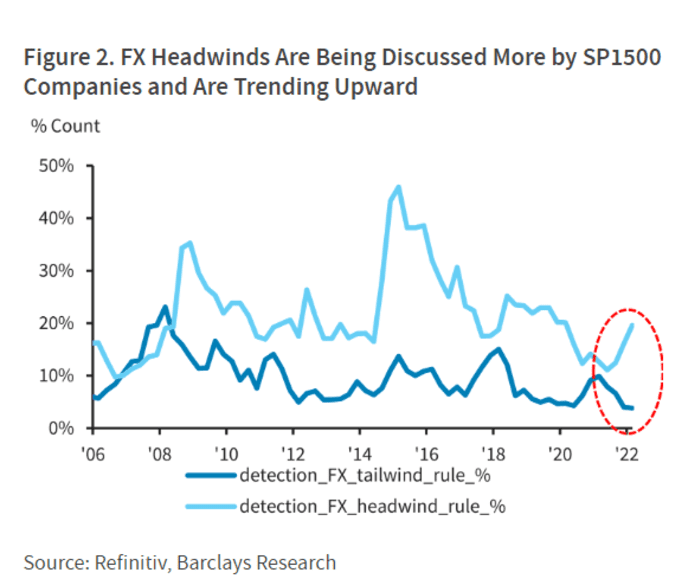

Barclays analysts called the appreciating dollar, along with inflation, a “notable market dynamic that has shown few signs of abatement,” in a Friday client note. So long as the dollar keeps rising, the team expects the spotlight to shine even brighter on the currency in corporate earnings reports.

The analysts already found that management at roughly 20% of companies (see chart) in the S&P Composite 1500 Index

SP1500,

have discussed foreign exchange as a headwind in earnings calls this year, nearly double from a few quarters ago.

Management increasingly views foreign exchange as a headwind

Barclays Research, Refinitiv

They also found that only about 5% of companies in the index described a strong dollar as a tailwind, a sharp decrease from recent quarters. The S&P 1500 index covers roughly 90% of the market capitalization of the U.S. equity market.

“ ‘Everything the Fed is doing is to try to slow inflation. But they’re not doing that without slowing the economy, and hurting equities.’”

Investors have looked for safety in havens like U.S. Treasury debt

TMUBMUSD10Y,

and dollars this year, as stocks and other risk assets have tumbled on fears that the Fed might go too far in its clamp down on inflation and spark a recession. Another concern is that high costs of living could rage out of control for sometime, potentially igniting longer-term carnage in the economy.

“Everything the Fed is doing is to try to slow inflation,” said Jack McIntyre, a portfolio manager for Brandywine Global Investment Management’s global fixed-income strategy. “But they’re not doing that without slowing the economy, and hurting equities.”

Bad news for credit

What’s more, McIntyre said uncertainty around the path to lower inflation “doesn’t bode well for credit as an investment vehicle.”

In a gut-wrenching 2022 for investors in stocks and bonds, total returns for U.S. investment-grade corporate bonds

LQD,

were negative 12.1% on the year through Friday, and minus 8% for high-yield,

HYG,

JNK,

according to Mizuho Securities.

McIntyre expects the Fed to keep tightening financial conditions until inflation recedes from its 8.3% annual rate, as of April, to the 3% range.

“It goes back to the Fed being in a tough spot,” he said, by phone. “To break the back of inflation, you have to tighten policy until that happens.”

U.S. stocks gave back a brief post-Memorial Day bounce to end the week in the red, with the S&P 500 index

SPX,

booking a 1.2% weekly loss, the Dow Jones Industrial Average

DJIA,

dropping 0.9% and the Nasdaq Composite Index shedding 1% for the week, according to FactSet.

Next week, U.S. economic data will include a consumer credit update on Tuesday, followed by revised wholesale inventories data Wednesday. Housing and jobless claims data will be released on Thursday. But the big one will be Friday’s release of the May Consumer Price Index.

Read: Fed will only need to get rates up to 3% to cool inflation, large-bank economists say

[ad_2]

Read More: A ‘pinch’ for the stock market but good news for the Fed: What investors need to know