[ad_1]

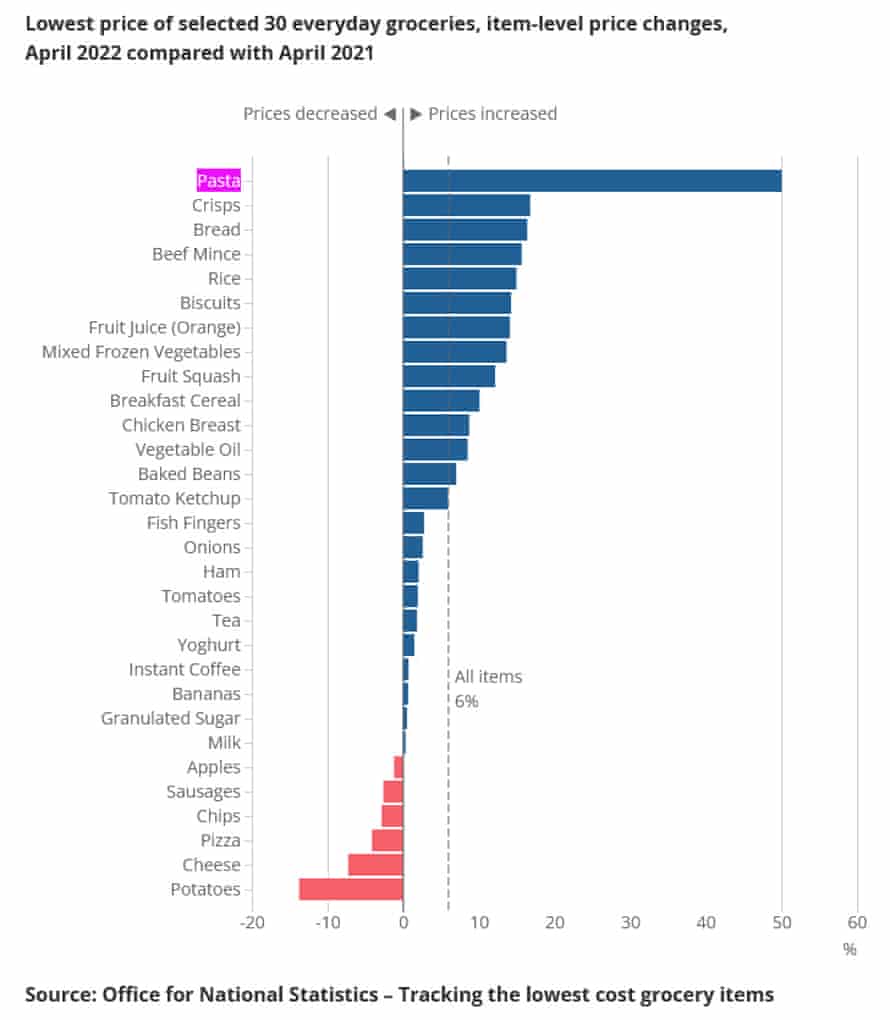

Here are some of the key data on inflation in budget ranges. The pasta surge is by far the most notable, but others include crisps (17%), bread (16%), minced beef (16%) and rice (15%).

Yet at the same time for six of the 30 items, the lowest prices fell on average over the year. Price decreases were measured for potatoes (down 14%), cheese (7%), pizza (4%), chips (3%), sausages (3%) and apples (1%).

Budget pasta prices up 50% amid scrutiny of inflation in value ranges

Budget pasta prices have inflated by 50% in the last year but overall supermarkets’ lower-price ranges have risen at about the same rate as food more generally, according to new analysis by the Office for National Statistics (ONS).

The analysis found that budget ranges had increased in price by about 6% to 7% in the year to April 2022, about the same as other food ranges.

The ONS carried out the research after concerns – raised most prominently by food writer Jack Monroe – that general inflation data were not showing the situation faced by the poorest who tend to rely more on budget or value ranges.

The analysis suggested how price increases (or the disappearence of budget ranges) could hit poorer shoppers, with a large step of 20% up to the next price point for two-thirds of the items tracked.

The ONS cautioned that it was “highly experimental research, based on web-scraped supermarket data for 30 everyday grocery items”, and pointed to a series of limitations to the data.

Sainsbury’s to commit £500m towards lower prices amid cost of living crisis

Sainsbury’s has said it will have committed £500m towards keeping prices down between March 2021 and March 2023, amid the “huge impact” of the cost of living crisis.

Britain’s second-largest supermarket chain said on Monday that the £500m figure includes actions already taken in the last year, plus some to be brought in for the year to come.

Milk, eggs, meat, fish, fruit and vegetables and “key household essentials” would be the targets for retaining lower prices, Sainsbury’s said. The announcement did not disclose how far it expects to increase prices outside of the core products, with households across Britain (and indeed the world) struggling with the higher price of energy. UK inflation is at a 40-year high of 9%.

Sainsbury’s made a net profit of £677m in the year to March 2022 and is estimated to make another £400m profit in the current financial year.

Simon Roberts, Sainsbury’s chief executive, said:

The cost of living is having a huge impact on our customers’ and colleagues’ lives and we understand that, right now, every penny counts.

In written comments, Roberts also made it unusually clear that the lower prices was aimed at retaining market share – an important consideration for the biggest UK supermarkets as they try to hold off competition from the likes of Aldi and Lidl, both German discount supermarkets. Customers “do not need to go anywhere else to get low prices,” he said.

The latest draft of the EU’s sanctions package against Russia suggests that it will follow the broad details briefed earlier – with the exemption for pipeline deliveries wanted by Hungary and other eastern European countries.

However, it looks like it will be left to the leaders of the EU’s member states to hash out agreement on final details later.

That deal would mean that Europe would continue to pay Russia for oil – a deeply controversial situation. And that is not to mention the billions of euros flowing to Russia for its natural gas.

25 days — and counting — #EU has failed to reach an agreement on banning Russian #oil imports. This #EU summit could represent a hard to recover debacle.

— Silvia Berzoni (@SilviaBerzoni) May 30, 2022

n”,”url”:”https://twitter.com/SilviaBerzoni/status/1531156777311653889″,”id”:”1531156777311653889″,”hasMedia”:false,”role”:”inline”,”isThirdPartyTracking”:false,”source”:”Twitter”,”elementId”:”92b55201-5af1-45eb-9755-903dee03cca6″}}”>

25 days — and counting — #EU has failed to reach an agreement on banning Russian #oil imports. This #EU summit could represent a hard to recover debacle.

— Silvia Berzoni (@SilviaBerzoni) May 30, 2022

Reuters reported that the draft announcement, which refers to the collection of heads of EU governments known as the European Council, said:

The European Council agrees that the sixth package of sanctions against Russia will cover crude oil, as well as petroleum products, delivered from Russia into Member States, with a temporary exception for crude oil delivered by pipeline.

The European Council therefore urges the Council to finalise and adopt it without delay, ensuring fair competition and a level playing field in the EU Single Market, and solidarity among Member States in case of sudden interruptions of supply.

It may be a fairly gentle gain for the FTSE 100, but it has neverthless pushed it to its highest point in a month.

Markets rallied at the end of last week, and have continued their momentum on Monday (albeit with the US trading desks likely to be absent later thanks to a holiday).

Some analysts ascribe the optimism on markets to the prospects of a Chinese economic recovery following a period of severe lockdowns that have disrupted the market that was previously the world’s growth engine.

Richard Hunter, head of markets at interactive investor, an investment platform, said:

Asian markets added to the positive momentum as China began to ease lockdown restrictions in both Beijing and Shanghai. The Premier has announced that there will be a range of measures aimed at boosting a beleaguered economy, with more detail to follow shortly.

However, the damage has largely been done over the last few months, with an inevitable drop in consumer sentiment tied to a soaring unemployment rate, and with many economists predicting a contraction in the current quarter. Even so, a perceived improvement to the fractious US/China relationship has also improved sentiment, particularly given the limitations which global economies have had to endure this year.

It is a fairly gentle start to the day for trading on the London Stock Exchange (and that might be expected to continue when there is a rare public holiday in the US, meaning Wall Street is closed). But there are some notable moves.

Among the mid caps on the FTSE 250 housebuilder Countryside is the clear stand-out: its shares have gained as much as 29% after San Francisco-based investor Inclusive Capital Partners (it likes to be known as In-Cap) made a £1.5bn takeover offer – the second approach within the last two months.

Countryside told In-Cap that it would not engage in negotiations, according to a stock market announcement on Monday – setting up the possibility of a higher bid.

In-Cap owned 9.2% of Countryside’s shares on Friday.

Introduction: EU’s Russian embargo plan pushes oil prices above $120 per barrel

Good morning, and welcome to our live coverage of business, economics, and financial markets.

Oil prices have hit a two-month high as traders anticipate a belated deal to limit Russian oil imports into the EU alongside other factors such as a recovery in demand in China as lockdown restrictions ease.

Brent crude futures prices rose above $120 per barrel on Monday morning for the first time since late March. The 50-cent gain for the day equated to a 0.4% increasein the North Sea benchmark, while its North American counterpart, West Texas Intermediate, also gained 0.7% to reach $115 per barrel.

The EU should be able to agree new sanctions, including on Russian oil, on Monday ahead of a summit of leaders from each country, according to its foreign policy chief, Josep Borrell.

Borrell told broadcaster France Info, according to Reuters:

We need to decide unanimously. There were tough talks yesterday afternoon, as well as this morning.

I think that this afternoon, we will be able to offer to the heads of the member states an agreement.

However, it remains to be seen whether the proposed ban will have teeth, with discord among European governments. Hungary in particular, led by Viktor Orbán who has long had a warm relationship with Russian President Vladimir Putin, has stood in the way of an embargo in recent weeks, partly because of the country’s dependence on Russian oil.

The EU is working on a compromise plan that ban Russian oil arriving in tankers but allow pipeline imports, meaning Hungary, Slovakia and the Czech Republic could continue to receive oil via the Soviet-era Druzhba pipeline that runs through Ukraine.

Asked if plans to include a ban to import Russian oil could fail over the resistance from Hungary and other eastern European states, Borrell said: “No, I don’t think so … there will be an agreement in the end.”

Europe’s stock markets have started the week on the front foot, with the Stoxx 600 index of European blue-chip companies gaining 0.7% in the opening trades. Germany’s Dax index was up 0.8% and France’s Cac 40 index gained 0.6%.

In the UK the FTSE 100 gained 0.4% and the mid-cap FTSE 250 rose by 0.9%.

US markets are closed today for the Memorial Day holiday.

The agenda

10am BST: Eurozone economic sentiment index (May; previous 105; consensus: 104.9)

1pm BST: Germany annual inflation rate (May; previous: 7.4%; consensus: 7.6%)

[ad_2]

Read More: Pasta, bread and beef mince top list of fastest-rising UK budget grocery prices –