[ad_1]

tiero/iStock via Getty Images

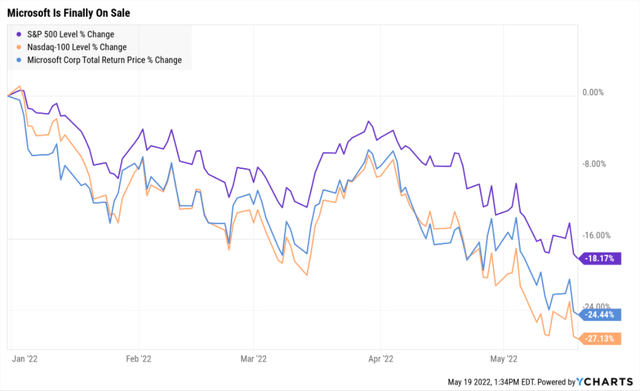

It’s been an extraordinary year for stocks.

On May 18th, the S&P fell 4%, and the Nasdaq almost 5%, the worst day for the market since June 11th, 2020.

For many popular growth stocks, it’s not just been a bear market but a complete collapse.

Charlie Bilello

Tech is getting slaughtered, with even some of the world’s best growth names down 50% to 75%…in just 4.5 months.

Warren Buffett is famous for saying, “It’s far better to buy a wonderful company at a fair price than a fair company at a wonderful price”.

So today, I wanted to bring to your attention an opportunity we haven’t seen in over two years.

Microsoft (NASDAQ:MSFT) is arguably the greatest company on earth.

And for the first time since the pandemic, it’s trading below fair value.

So, let me show you the four reasons why Microsoft isn’t just a potentially good buy here, but potentially the ultimate Buffett-style wonderful company at a fair price.

Or to put it another way, let me show you why I just bought MSFT and you might want to consider doing the same.

Reason One: Microsoft Is The Complete Package

Bottom line up front, MSFT is an exceptional company.

Reasons To Potentially Buy MSFT Today

- 100% quality low-risk 13/13 Ultra SWAN hyper-growth software company

- 100% dividend safety score

- 0.5% average recession cut risk

- 1.0% severe recession cut risk

- 0.9% very safe yield (same as Nasdaq’s)

- 18-year dividend growth streak (every year since they began paying one)

- 6% conservatively undervalued (potential good buy)

- Fair Value: $270.21 (25.4X earnings)

- 23.7X forward earnings vs 22X to 25.5X historical (Nadella Era, current business model)

- 17.5X cash-adjusted earnings = growth at a reasonable price

- AAA stable outlook credit rating =0.07% 30-year bankruptcy risk

- #1 credit rating in America

- 85th industry percentile risk management consensus = very good

- 13% to 20% CAGR margin-of-error growth consensus range

- 12.3% to 22.0% CAGR individual analyst growth range

- 15.8% CAGR median growth consensus

- 5-year consensus total return potential: 10% to 16% CAGR

- base-case 5-year consensus return potential: 14% CAGR (2X S&P consensus)

- consensus 12-month total return forecast: 40% (overly bullish)

- Fundamentally Justified 12-Month Returns: 4% CAGR

MSFT is in a 25% bear market not justified by its strong fundamentals.

- Its peak 40X PE made it approximately 58% overvalued

MSFT Investment Thesis Is Intact

| Metric | 2020 Growth | 2021 Growth Consensus | 2022 Growth Consensus | 2023 Growth Consensus |

2024 Growth Consensus |

| Sales | 15% | 19% | 20% | 15% | 13% |

| Dividend | 11% | 10% | 11% | 10% | 11% |

| EPS | 21% | 38% | 17% | 16% | 17% |

| Operating Cash Flow | 17% | 28% | 19% | 16% | 14% |

| Free Cash Flow | 19% | 25% | 19% | 15% | 17% |

| EBITDA | 21% | 25% | 24% | 16% | 14% |

| EBIT (operating income) | 25% | 33% | 22% | 15% | 16% |

(Source: FAST Graphs, FactSet)

MSM’s growth thesis remains firmly intact.

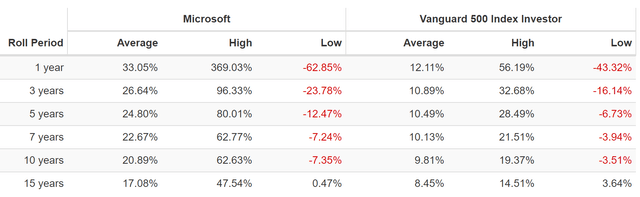

MSFT Rolling Returns Since April 1986

(Source: Portfolio Visualizer Premium)

MSFT has been a very consistent market-beater over the last 36 years, with 17+% average rolling returns.

- from bear market bottoms returns as strong as 48% annually over the next 15 years

- 342X return over a 15-year

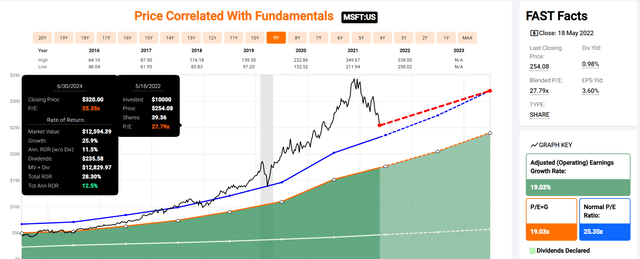

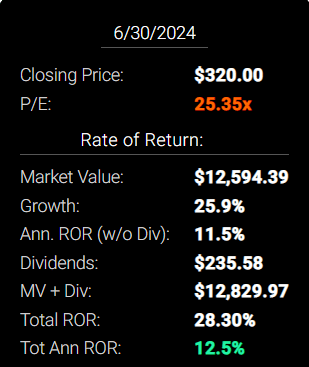

MSFT 2024 Consensus Total Return Potential

(Source: FAST Graphs, FactSet)

(Source: FAST Graphs, FactSet)

If MSFT grows as analysts expect by 2024 it could deliver 28% total returns, or 13% annually.

- slightly better than market returns

- with far higher quality and safety

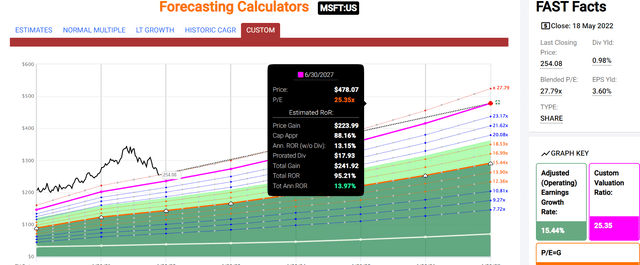

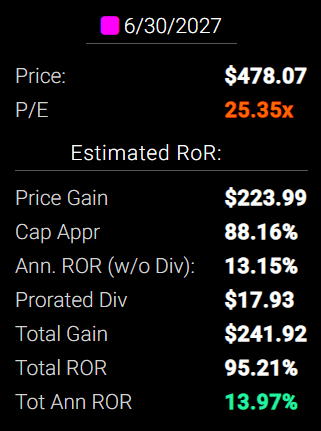

MSFT 2027 Consensus Total Return Potential

(Source: FAST Graphs, FactSet)

(Source: FAST Graphs, FactSet)

By 2027, if MSFT grows as expected (15.4% CAGR) and returns to historical fair value, it could deliver 95% total returns or 14% annually.

MSFT Long-Term Consensus Total Return Potential

| Investment Strategy | Yield | LT Consensus Growth | LT Consensus Total Return Potential | Long-Term Risk-Adjusted Expected Return | Long-Term Inflation And Risk-Adjusted Expected Returns | Years To Double Your Inflation & Risk-Adjusted Wealth |

10 Year Inflation And Risk-Adjusted Expected Return |

| Adam’s Planned Correction Buys | 4.1% | 19.2% | 23.3% | 16.3% | 13.8% | 5.2 | 3.63 |

| Microsoft | 0.9% | 15.80% | 16.7% | 11.7% | 9.1% | 7.9 | 2.40 |

| Nasdaq (Growth) | 1.0% | 14.3% | 15.3% | 10.7% | 8.1% | 8.8 | 2.19 |

| Dividend Aristocrats | 2.2% | 8.9% | 11.1% | 7.8% | 5.2% | 13.8 | 1.66 |

| S&P 500 | 1.7% | 8.5% | 10.2% | 7.1% | 4.6% | 15.7 | 1.57 |

(Sources: Morningstar, FactSet, Ycharts)

- analysts expect MSFT to beat almost all growth investment strategies on Wall Street in the long-term

- including the Nasdaq, aristocrats, and S&P 500

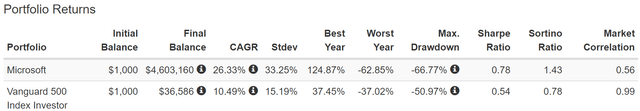

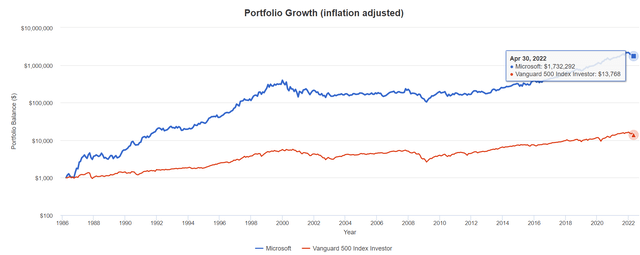

MSFT Total Returns Since April 1986

(Source: Portfolio Visualizer Premium)

(Source: Portfolio Visualizer Premium)

MSFT has delivered 1,733X inflation-adjusted returns since April 1986, about 126X better than the S&P 500.

What do analysts expect in the future?

Inflation-Adjusted Consensus Return Potential: $1,000 Initial Investment

| Time Frame (Years) | 7.7% CAGR Inflation-Adjusted S&P Consensus | 8.7% Inflation-Adjusted Aristocrat Consensus | 14.3% CAGR Inflation-Adjusted MSFT Consensus | Difference Between Inflation Adjusted 12 Hyper-growth Ultra SWANs Consensus And S&P Consensus |

| 5 | $1,445.67 | $1,514.08 | $1,946.62 | $500.95 |

| 10 | $2,089.97 | $2,292.44 | $3,789.33 | $1,699.36 |

| 15 | $3,021.42 | $3,470.93 | $7,376.38 | $4,354.96 |

| 20 | $4,367.98 | $5,255.26 | $14,359.00 | $9,991.02 |

| 25 | $6,314.67 | $7,956.89 | $27,951.51 | $21,636.83 |

| 30 | $9,128.95 | $12,047.36 | $54,410.94 | $45,281.99 |

(Source: DK Research Terminal, FactSet)

Even if MSFT only grows as expected over the next 10 years, that’s a very impressive 4X inflation-adjusted consensus potential.

| Time Frame (Years) | Ratio Aristocrats/S&P 500 | Ratio Inflation-Adjusted MSFT Consensus And S&P Consensus |

| 5 | 1.05 | 1.35 |

| 10 | 1.10 | 1.81 |

| 15 | 1.15 | 2.44 |

| 20 | 1.20 | 3.29 |

| 25 | 1.26 | 4.43 |

| 30 | 1.32 | 5.96 |

(Source: DK Research Terminal, FactSet)

MSFT can’t beat the market by 126X in the future, but it could double the market over the next decade and outperform by impressive amounts in the coming decades.

- all with the highest safety and quality you can find on Wall Street

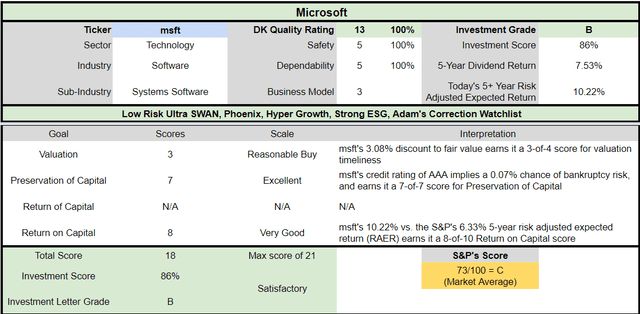

MSFT Investment Decision Score

(Source: DK Automated Investment Decision Tool)

For anyone comfortable with its risk profile, MSFT is one of the most reasonable and prudent hyper-growth Ultra SWANs you can buy today.

- 6% discount vs 1% market discount = 5% better valuation

- 60% higher long-term return potential than S&P 500 overtime

- about 2X better risk-adjusted expected return over the next five years

Reason Two: Quite Possibly The Highest Quality Company On Earth

There are many ways to measure safety and quality and I factor in pretty much all of them.

The Dividend Kings’ overall quality scores are based on a 244-point model that includes:

-

Dividend safety

-

Balance sheet strength

-

Credit ratings

-

Credit default swap medium-term bankruptcy risk data

-

Short and long-term bankruptcy risk

-

Accounting and corporate fraud risk

-

Profitability and business model

-

Growth consensus estimates

-

Management growth guidance

-

Historical earnings growth rates

-

Historical cash flow growth rates

-

Historical dividend growth rates

-

Historical sales growth rates

-

Cost of capital

-

GF Scores

-

Long-term risk-management scores from MSCI, Morningstar, FactSet, S&P, Reuters’/Refinitiv, and Just Capital

-

Management quality

-

Dividend friendly corporate culture/income dependability

-

Long-term total returns (a Ben Graham sign of quality)

-

Analyst consensus long-term return potential

In fact, it includes over 1,000 fundamental metrics including the 12 rating agencies we use to assess fundamental risk.

-

credit and risk management ratings make up 41% of the DK safety and quality model

-

dividend/balance sheet/risk ratings make up 82% of the DK safety and quality model

How do we know that our safety and quality model works well?

During the two worst recessions in 75 years, our safety model 87% of blue-chip dividend cuts, the ultimate baptism by fire for any dividend safety model.

How does MSFT score on our comprehensive safety and quality models?

MSFT Dividend Safety

| Rating | Dividend Kings Safety Score (162 Point Safety Model) | Approximate Dividend Cut Risk (Average Recession) |

Approximate Dividend Cut Risk In Pandemic Level Recession |

| 1 – unsafe | 0% to 20% | over 4% | 16+% |

| 2- below average | 21% to 40% | over 2% | 8% to 16% |

| 3 – average | 41% to 60% | 2% | 4% to 8% |

| 4 – safe | 61% to 80% | 1% | 2% to 4% |

| 5- very safe | 81% to 100% | 0.5% | 1% to 2% |

| MSFT | 100% | 0.5% | 1.0% |

| Risk Rating | Low-Risk (85th industry percentile risk-management consensus) | AAA Stable outlook credit rating 0.07% 30-year bankruptcy risk | 20% OR LESS Max Risk Cap Recommendation |

Long-Term Dependability

| Company | DK Long-Term Dependability Score | Interpretation | Points |

| Non-Dependable Companies | 21% or below | Poor Dependability | 1 |

| Low Dependability Companies | 22% to 60% | Below-Average Dependability | 2 |

| S&P 500/Industry Average | 61% (61% to 70% range) | Average Dependability | 3 |

| Above-Average | 71% to 80% | Very Dependable | 4 |

| Very Good | 81% or higher | Exceptional Dependability | 5 |

| MSFT | 100% | Exceptional Dependability | 5 |

Overall Quality

| MSFT | Final Score | Rating |

| Safety | 100% | 5/5 very safe |

| Business Model | 100% | 3/3 wide moat, stable |

| Dependability | 100% | 5/5 exceptional |

| Total | 100% | 13/13 Ultra SWAN |

| Risk Rating | 3/3 Low Risk | |

| 20% OR LESS Max Risk Cap Rec |

5% Margin of Safety For A Potentially Good Buy |

Microsoft is the #1 highest quality company on the DK Master List.

And that’s saying something because look at what’s on that list.

The DK 500 Master List includes the world’s highest quality companies including:

-

All dividend champions

-

All dividend aristocrats

-

All dividend kings

-

All global aristocrats (such as BTI, ENB, and NVS)

-

All 13/13 Ultra Swans (as close to perfect quality as exists on Wall Street)

- 49 of the world’s best growth stocks

Basically, MSFT is as close to God’s own company as can exist on Wall Street.

Why I Trust Microsoft And So Can You

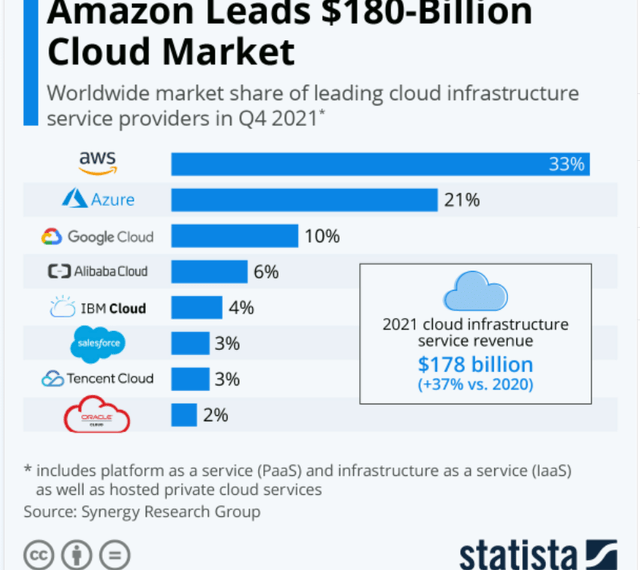

Microsoft was founded in 1975 and is today the #1 largest software company on earth and the 2nd biggest in cloud computing.

Since taking over as CEO in 2014, Satya Nadella has reinvented Microsoft into a cloud leader. In our view, Microsoft has become one of two public cloud providers that can deliver a wide variety of PaaS/IaaS solutions at scale. Additionally, Microsoft embraced the open-source movement and has largely transitioned from a traditional perpetual license model to a subscription model. Finally, Microsoft exited the low-growth, low-margin mobile handset business and is driving Gaming to be more cloud-based. These factors have combined to drive a more focused company that offers impressive revenue growth with high and expanding margins.” -Morningstar

Satya Nadella pivoted the company in 2014 to focus on recurring revenue and cloud computing.

In 2021, cloud computing grew at 37% while Microsoft’s cloud business grew at 50%.

Cloud Computing Market Size Worth $1,554.94 Billion by 2030: Grand View Research, Inc.

Grandview research expects the global cloud market to grow about 16% annually through 2030, meaning that AMZN is…

[ad_2]

Read More: Microsoft Is The Ultimate Wonderful Company At A Fair Price (NASDAQ:MSFT)