[ad_1]

Shares of ProFrac Holding Corp. powered to a fresh high Tuesday, after Wall Street gave the fracking services company a unanimously bullish endorsement, a little less than a month after a relatively disappointing public debut.

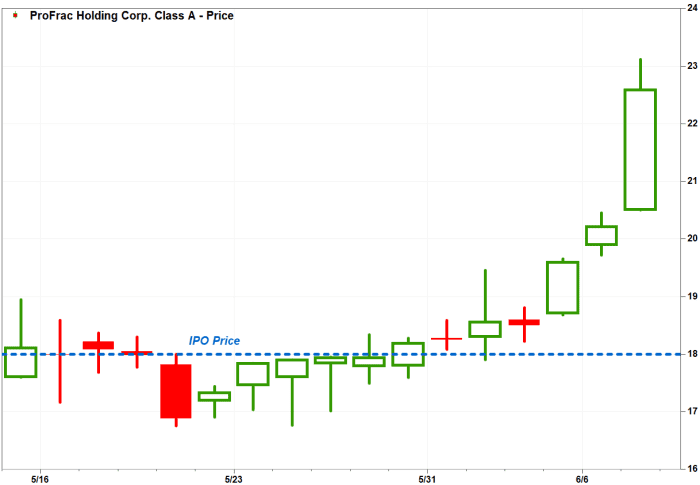

The Willow Park, Texas-based company went public on May 13, after its initial public offering priced at $18 a share, well below the expected range of between $21 and $24. The company raised $288 million in the IPO, with the pricing valuing the company at about $2.5 billion.

The stock

PFHC,

opened its first day below the IPO price, at $17.60, but bounced to close just above it at $18.11. It then closed below the IPO price in eight of the next nine sessions through May 26, but has closed above it since then.

Don’t miss: Investors hoping to pounce on summer IPOs may be out of luck. Here’s why.

The stock shot up 11.7% in afternoon trading Tuesday, putting it on track for the best one-day performance since the IPO. It has soared 25.9% since it last closed below the IPO price.

No less than four analysts initiated coverage of ProFrac on Tuesday, all with the equivalent of buy ratings. The average price target of the four analysts was $26.25, or 46% above the IPO price.

The most bullish was Morgan Stanley’s Connor Lynagh, who had the highest stock price target of $30.

Lynagh said the company was a “high quality, vertically integrated frac contractor poised for multiple expansion,” if management can continue to deliver peer-leading results. In addition, following substantial industry consolidation and capacity attrition over the past few years, Lynagh believes the hydraulic fracturing industry “is entering a bull market.”

FactSet, MarketWatch

The next-most bullish was Seaport Research’s Tom Curran, who placed a $26 target on the stock.

Curran believes industry frac capacity utilization should stay “very high” and support of pumper pricing power through 2023 on strengthening demand.

“Within this framework, we expect [ProFrac] to increase its average active count from 31 for 2Q2022 to 40 for 4Q2023 while achieving net pricing gains as it leverages in-house manufacturing and technology advantages, successfully optimizes the legacy [FTS International Inc.] fleet, and rolls out several e-frac spreads,” Curran wrote.

J.P. Morgan analyst Arun Jayaram started with a price target of $25, saying ProFrac’s stock was trading at significant discounts to its primary frac peers. Despite this discount, Jayaram said ProFrac’s in-house manufacturing facilities are “a competitive moat” as it provides the company with the ability to repair and maintain its frac fleet as well as complete fuel grades at significant discounts to its peers.

Analyst Stephen Gengaro at Stifel Nicolaus placed a $24 target on ProFrac’s stock, saying he expects “robust” revenue and adjusted earnings growth at least through 2023, supported by strong industry fundamentals.

The company has recorded a net loss of $42.4 million on revenue of $768.4 million in 2021, after a loss of $117.4 million on revenue of $547.7 million in 2020.

The stock has rallied 24.7% from its close on its first day, while the shares of fellow fracking services company ProPetro Holding Corp.

PUMP,

have climbed 9.8% and the S&P 500 index

SPX,

has tacked on 2.7% over the same time.

[ad_2]

Read More: ProFrac gets a unanimously bullish endorsement from Wall Street