[ad_1]

Don’t miss CoinDesk’s Consensus 2022, the must-attend crypto & blockchain festival experience of the year in Austin, TX this June 9-12.

Our new Constitution is now established, and has an appearance that promises permanency; but in this world nothing can be said to be certain, except death and taxes.

Benjamin Franklin

The human brain evolved to forecast.

Born into a world of uncertainty, early humans had to manage threats, weather and food sources to survive. Evolution has ensured that humans are good at this and further that we enjoy it.

Today, we grapple with similar issues. Will monkeypox be a serious pandemic? Will Russia and the North Atlantic Treaty Organization directly engage? China-Taiwan? Climate change? Global food supply?

It is impossible to answer these questions in advance. The future is uncertain, and the systems these questions deal with are too complex and interdependent for total foresight. But this doesn’t preclude patterns. And as a result, we can generate reliable, partial foresight. You cannot definitely say if a parent is angry or disappointed when they call for you, but hearing your full name is one heck of a signal. By investigating patterns based on the accumulation of experiences and knowledge, humans have developed frameworks to quantify uncertainty and predict.

Clay Graubard and Andrew Eaddy are the founders of Baserate.io, the publisher of Global Guessing, a geopolitical forecasting site, and Crowd Money, a newsletter and podcast about prediction markets. This article is a preview of a talk they will give next week on the Big Ideas stage at Consensus 2022 in Austin, Texas.

Weather forecasting, once thought to be futile despite milenia of practice, is reliably wrong enough to trust. You won’t know at 8 a.m. whether it will rain at 2 p.m., but advances in meteorology have enabled the Dark Sky app to predict a 24% chance. Sure, unlikely. But in 2016 Nate Silver gave former U.S. President Donald Trump a 28.2% chance to be elected president, and so it is probably wise to take an umbrella.

In the social sciences, we’ve identified that two democracies are less likely to go to war with one another than other combinations of states, that crimes are more likely to occur in neighborhoods with “broken windows,” that civil wars are nearly twice as likely in countries with gross domestic product per capita of $250 as in those at $500 (15% versus 8%).

Barring belief in preordination, we live in a probabilistic world. Forecasting is something we all do, whether or not we know it. It is a tool, it is a process, and critically, it is a skill to generate information. Thankfully, it is a skill we can improve and get good at.

That, in essence, is the core takeaway from the research of Philip E. Tetlock, Barbara Mellers and many others. Their research has shown that if we quantify, record, update, score and practice, we can make accurate predictions on complex questions. We can see at least part way through the “fog of war.”

This is why we should pay attention when forecasters say there is a 28% chance the World Health Organization declares monkeypox a public health emergency of international concern. Or a 10% chance there is direct Russia-NATO conflict before July 2023 and a 15% chance of a China-Taiwan war before 2024. Etc. Etc.

This is also why we should be surprised, and even take issue, with how little attention and funding forecasting receives.

Read More: Consensus 2022 Speaker Profile: Clay Graubard

Forecasting produces good information, forces accountability (you cannot brush aside a track record!) and rejects sophistry, sensationalism and biased thinking. It is a perfect check on traditional media outlets and a potential antidote to polarization. One cannot forecast while ignoring an important perspective. Otherwise, accuracy suffers. This is perhaps why forecasters have been found to be less politically polarized than non-forecasters.

Unfortunately, having value doesn’t guarantee immediate, or even relatively timely, widespread use. History is replete with such examples, including even more obvious things such as seat belts. Forecasting is an inherently disruptive practice, making corporate adoption challenging.

Forecasting is also difficult, time consuming and (for now) underpaid (trust us). Adoption will require many approaches, and we believe prediction markets are one of the most hopeful by bringing monetary and psychological incentives and market efficiencies into the forecasting process.

Prediction markets are not new. Individuals have made bets on the future outcome of events since ancient times. And the coined phrase “the wisdom of crowds” can be traced back to early 20th-century England.

In 1906-1907, Sir Francis Galton, a scientist and mathematician from Birmingham and relative of Darwin, witnessed a competition in which roughly 800 villagers in Plymouth, England were challenged to estimate the weight of an ox. While each individual estimate was too high or too low, Galton observed that the median was within 0.8% of the weight measured by the competition’s judges. The mean estimate was exactly right.

Prediction markets are marketplaces where participants trade on future outcomes about particular topics. Think of the stock or crypto markets, but dealing with events.

Prediction markets are typically binary, offering two fungible assets for a given market (think “Yes” or “No”). These assets trade between 0% and 100% (think $0 to $1), with the current market price representing the crowd consensus.

When a forecasted event occurs, traders who purchased shares of the correct outcome are paid $1 for each share that they owned. Similar to long-established public equities markets, the primary incentive for participants in prediction markets is profit, while the byproduct of their forecasting activity is information.

Read More: Consensus 2022 Speaker Profile: Andrew Eaddy

But while traditional prediction markets often function as described above, it is important to contextualize this technology within the larger ecosystem of prediction platforms that use different methods to elicit predictions. There are prediction markets that use real or play money. (Among the real money platforms, some place bets in fiat, others in crypto.)

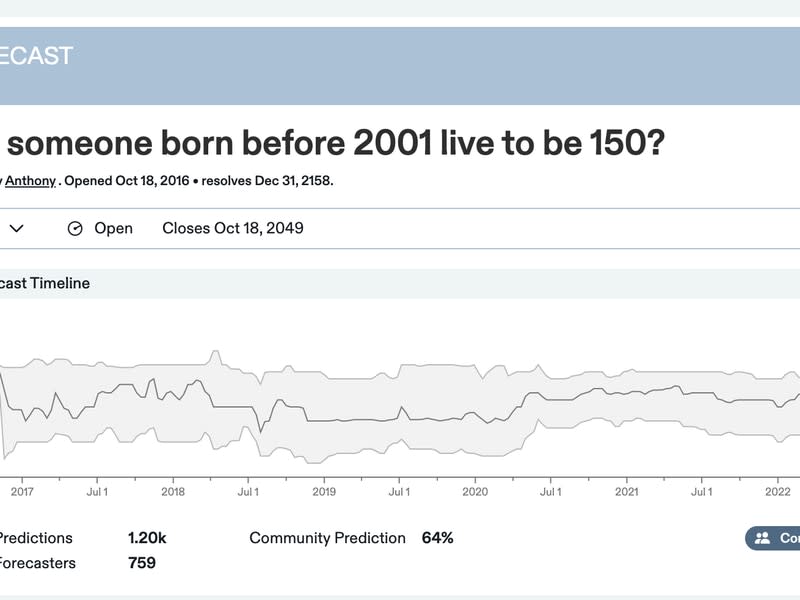

Other platforms like Metaculus use a poll-based method where people continually give their subjective probability assessments of a question. Many of these platforms incentivize reputation, community and other factors to further generate high-quality information.

One benefit of prediction markets over other methods is that, all else being equal, they generate more accurate forecasts than traditional prediction platforms (or polls) such as Good Judgment Open. The forecasts they produce are less biased, less noisy and more informed.

Another benefit is that betting makes things more exciting, and often increases engagement, not only on hot topics such as sports, but on other important and yet neglected ones like the risks to humanity from artificial intelligence. And given that individuals can produce consistently accurate and well-calibrated forecasts, there is an opportunity for smart traders and elite forecasters to generate reliable returns—particularly because returns for accuracy can compound over time.

Writ large, modern-day prediction markets continue to build on this finding, creating more efficient and replicable means of aggregating predictions to produce accurate information. Within the ecosystem, however, there are different categories and classifications for prediction market platforms.

Some prediction markets, like Kalshi, are centralized and use U.S. dollars to support trading. Others, like Polymarket, are partially decentralized and trade using the stablecoin USDC. And still others, like Augur, are fully decentralized, complete with decentralized oracles to facilitate decentralized question resolution.

There are differences between prediction markets related to their stated purpose as well. For example, Google has been using prediction markets internally to improve business decisions and understand employee sentiment since 2008. The incentive structure and functionality of a prediction market like Google’s will understandably diverge from those of a publicly accessible prediction market.

Finally, there are differences in prediction markets’ technical functionality, as well. Some prediction market platforms, namely those on blockchains, use automated market makers (AMMs) to provide liquidity. Other platforms use a more traditional order book-based trading system.

AMMs provide consistent liquidity to a market and often result in a more positive trading experience for market participants, but if liquidity dries up, slippage can occur, meaning that order sizes can affect order prices, which isn’t good. Order book trading, on the other hand, is much simpler. A trading screen displays a selection of buy orders and sell orders for an asset at various prices. As a trader, you can fill any order in the book.

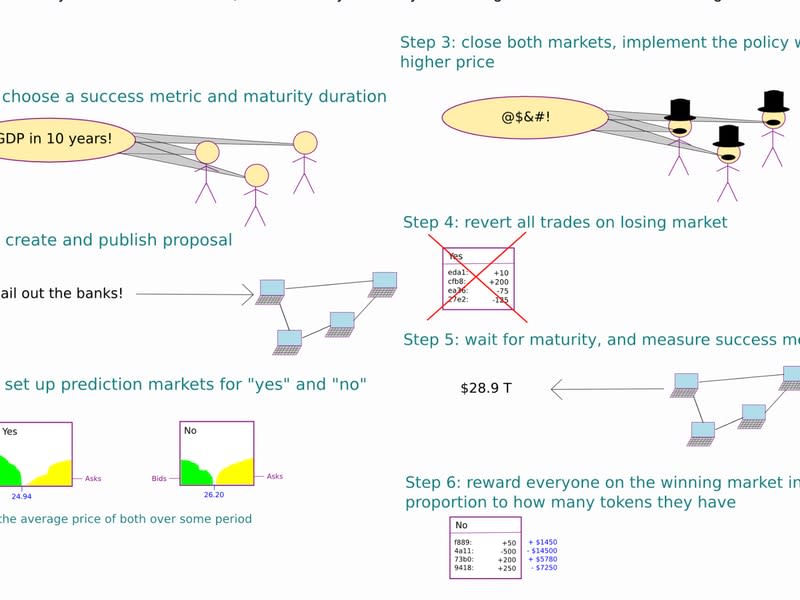

Aside from enhancing the accuracy of forecasts and boosting engagement, prediction markets can help reform the media, drive community on social media and inform key decision makers in the private and public sectors through systems such as Robin Hanson’s Futarchy depicted below.

Such a system would reward thoughtful and involved citizens. It would also incentivize good decision making because even if you pick the “correct” and implemented policy, to win money, it has to work. Over time, bad forecasters would be weeded out. Through Futarchy, prediction markets can support fundamental and vital values within a healthy society, namely information (through forecasting), governance (through Futarchy) and institutions (prediction markets).

Read More: Polymarket’s CFTC Fine Hints at DeFi Regulation Roadmap

Even short of Futarchy, prediction markets have the potential to transform today’s political process by involving people in the conversation and delivering more reliable information about the future.

We live in uncertain and complex worlds. Critical thinking and reliable information are required when making good decisions. Quantified forecasting is an invaluable and yet underused tool, and prediction markets appear a vital tool for its adoption. We at baserate.io believe this needs to happen sooner rather than later, because even certainties such as death may now be uncertain.

[ad_2]

Read More: Forecasting, Prediction Markets and the Age of Better Information