[ad_1]

CONTRIBUTED CONTENT — If your kids aren’t already learning about budgeting and healthy financial habits, there’s no better time than today to start.

In celebration of April as National Financial Literacy Month, State Bank of Southern Utah reached out to all high schools within their service area to encourage teenagers to participate in an essay contest.

Students were asked to visit the bank’s Dollars & Sense online financial literacy program and complete a module on budgeting, then write a 500-word essay about what they learned and how they would apply it to their life. The contest generated over 60 submissions.

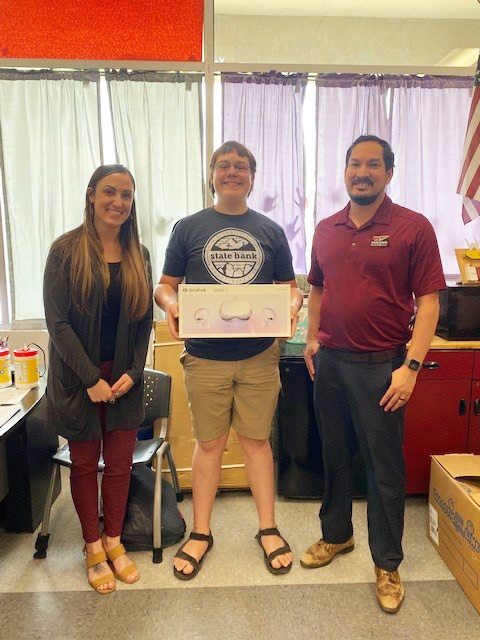

Kaden Racker from St. George Academy and Riley Johnson from Parowan High School were chosen as the winners. Each won an Oculus Quest 2 virtual reality headset.

State Bank of Southern Utah Digital Marketing Manager Tony Walser said both of their essays showed a complete understanding and implementation of the “50-30-20” rule for budgeting, just in different ways.

The Dollars & Sense program teaches that 50% of a person’s income is usually allocated to needs like rent and utilities, 30% can be used for wants like dining out and shopping and 20% should be put into savings.

Kaden adapted the method to better suit his needs. As a teenager living at home with his parents, he allocated money that would otherwise be spent on housing to savings instead, creating a “40-30-30” rule.

“He put some critical thinking into it and was able to come up with his own budget that would fit his life,” Walser said.

Riley, on the other hand, took the budgeting method and provided specific examples of what he’d allocate to each category, like a car payment, going to the movies with friends and ordering takeout. He also outlined areas where he would tighten up his budget and sacrifice some wants.

“He gets a soda every day from Maverik and suggested he could forgo that to save for things he needs,” Walser said.

State Bank of Southern Utah created the Dollars & Sense online education program to teach both parents and kids various aspects of financial literacy. The self-paced learning modules, each lasting no more than 10 minutes, cover subjects such as building financial capability, making prudent investments, owning a home and preparing for retirement. This wealth of information about healthy financial habits is available at no cost to everyone in the community, not just bank customers.

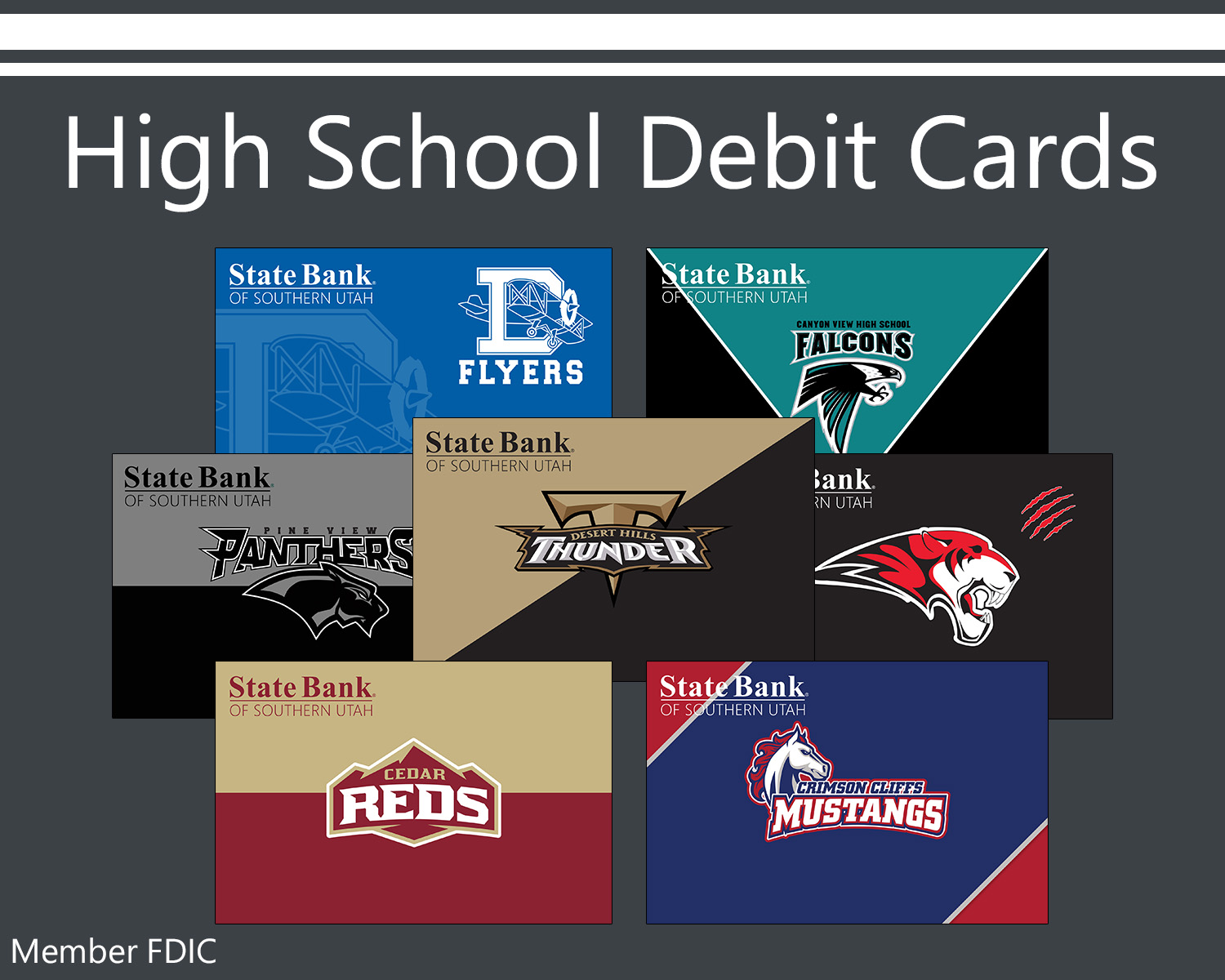

Financial independence begins with a student account from State Bank of Southern Utah. Use of a debit card and digital account access makes everyday money management more convenient while laying the foundation for healthy financial habits.

The student account is available to all kids under age 25 and offers easy online sign-up, no monthly fees and a minimum opening deposit of just $10. High school students can choose to customize their debit card to show school spirit at no additional cost, with themed cards representing over 20 local schools from Richfield to Snow Canyon.

“We just want kids to learn about finances,” Walser said. “It’s something they need to know before they graduate and go to college and live on their own. The younger they learn, the more prepared they’ll be to succeed.”

Serving the community since 1957, State Bank of Southern Utah is the only financial institution owned, operated and headquartered in Southern Utah. It holds over $2.2 billion in assets and operates 16 branches across 14 cities and towns: Cedar City, Circleville, Delta, Escalante, Fillmore, Gunnison, Hurricane, Kanab, Orderville, Parowan, Richfield, Santa Clara, St. George and Tropic.

State Bank of Southern Utah has flourished by focusing on the needs of its customers for more than 60 years. The bank was founded with a mission to empower individuals and businesses to take control of their financial destiny, therefore elevating the quality of life for everyone in the community.

For more information about State Bank of Southern Utah, visit their website. The bank is an equal housing lender and member of the FDIC.

Written by ALEXA MORGAN for St. George News.

• S P O N S O R E D C O N T E N T •

Copyright St. George News, SaintGeorgeUtah.com LLC, 2022, all rights reserved.

[ad_2]

Read More: State Bank of Southern Utah awards 2 local students in financial literacy essay contest