[ad_1]

After losing four percent each in previous two weeks, Indian markets bounced back gaining three percent in the highly volatile week ended May 20 despite worries over rising inflation, persistent foreign institutional investor (FII) selling and mixed global cues.

For the week, BSE Sensex added 1,532.77 points (2.90 percent) to close at 54,326.39 while the Nifty50 rose 484.05 points (3.06 percent) to end at 16,266.2.

The BSE Sensex and Nifty50 recovered some of their monthly losses but were still down nearly four percent in the month of May till now.

On the sectoral front, BSE Metal index surged 7.3 percent, BSE Capital Goods index added 5.3 percent and BSE FMCG, Auto and Realty indices gained four to five percent. On the other hand, Information Technology index fell two percent.

The BSE Small-cap index rose four percent, Mid-cap and Large-cap indices were up three percent each.

“The Nifty had a volatile week where it witnessed sharp swings in both the directions and ultimately posted a positive weekly close. The steep decline on May 19 was arrested near the swing low of 15,735. The March low of 15,671 offered additional support on the downside. Thus the index took a strong leap on the upside on May 20,” Gaurav Ratnaparkhi, head of technical research at Sharekhan by BNP Paribas.

“With this, it filled up the recently created gap area on the daily chart. Going ahead, the index is set to test the upper end of a reverse falling channel and the swing high of 16,400 which is a key barrier to watch out for. On the flip side 16,100-16,000 will act as a near term support zone,” he added.

FIIs continued selling as they offloaded equities worth of Rs 11,401.34 crore while domestic institutional investors (DIIs) bought shares worth of Rs 9,472.91 crore.

In May so far FIIs have sold equities worth Rs 44,102.37 crore and DIIs have bought shares worth Rs 36,208.27 crore.

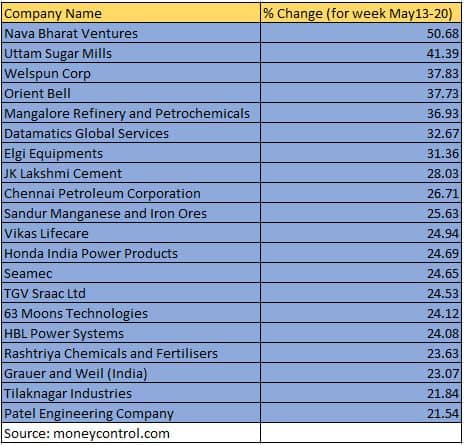

In this week, more than 100 smallcap stocks rose 10-50 percent with the following adding 20-50 percent: Nava Bharat Ventures, Uttam Sugar Mills, Welspun Corp, Orient Bell, Mangalore Refinery and Petrochemicals, Datamatics Global Services, Elgi Equipments, JK Lakshmi Cement, Chennai Petroleum Corporation, Sandur Manganese and Iron Ores, Vikas Lifecare, Honda India Power Products, Seamec, TGV Sraac, 63 Moons Technologies, HBL Power Systems, Rashtriya Chemicals and Fertilisers, Grauer and Weil (India), Tilaknagar Industries, Patel Engineering Company, Easy Trip Planners, Emami Paper Mills, IRB Infrastructure Developers, and National Fertilizers.

On the other hand, Birla Tyres, Future Retail, Amber Enterprises India, Muthoot Capital Services, Dr Lal PathLabs, Asian Granito India, Metropolis Healthcare, and Brightcom Group lost 10-22 percent.

“The Nifty 50 ended the week on a positive note and both the benchmark index and the Bank Nifty recovered from last week’s lows. Despite the rebound, we feel the market has not reached its bottom since price patterns on the Nifty show that the uptrend has been significantly harmed. Similarly, a Head and Shoulder breakdown has been seen on the weekly chart of the S&P 500 index,” said Yesha Shah, head of equity research at Samco Securities.

“Having said this, a short-term rebound cannot be ruled out and at this point it is unclear if the bounce will be a relief rally or the start of a fresh bullish surge.”

“Taking all of this into account, we recommend that traders keep a cautiously bullish stance for the coming week as long as the Nifty does not break below 15,700 levels,” he added.

Among midcaps, Adani Power, JSW Energy, Hindustan Aeronautics, Bharat Heavy Electricals, CRISIL, Balkrishna Industries, LIC Housing Finance, PI Industries added 10-17 percent.

BSE 500 index rose over three percent led by Welspun Corp, Mangalore Refinery and Petrochemicals, Elgi Equipments, JK Lakshmi Cement, Ruchi Soya Industries, Rashtriya Chemicals and Fertilisers, Adani Power and IRB Infrastructure Developers adding over 20 percent each.

“Nifty started this week around the 15800 mark and surpassed the 16000 mark, we saw a sharp upmove in the index towards 16400 in just couple of sessions. The sharp sell-off in the global markets then lead to a huge gap down on the weekly expiry day and the market resumed its downmove to end around 15800 again,” said Ruchit Jain, lead research, 5paisa.com.

“However, it was not done with it yet, surprisingly the index again rallied sharply on the last trading session and it ended this volatile week above 16,250 with weekly gains of over three percent.

“It was one of the most difficult week for traders as markets have oscillated sharply on both the sides. The alternate bouts of buying and selling perplexed market participants as to the primary trend of the index.

“In our view, the recent activity in the Nifty where it has taken support several times as it approached 15,700-15,800 and has faced resistance around 16400 has changed the trend from down to sideways. The index has formed a broad range of 15,700-16,400 where we can see multiple supports and ’20 DEMA’ hurdle on the higher end i.e. around 16,400,” Jain added.

Where is Nifty50 headed?

Ajit Mishra, VP – Research, Religare Broking

Markets have been seeing a roller-coaster ride and the key is to manage the overnight risk. Going ahead, global cues, the last leg of earnings and updates on the Russia-Ukraine war will be on the radar. We reiterate our advice to focus more on managing risk and preferring hedged bets.

Manish Shah, Independent Technical Analyst:

Nifty is currently far away from its 50 and 20 period moving average. Sooner or later it will revert to the mean. Minor swing high in Nifty is at 16,400. A break above 16,400 should trigger a rally to 16,650-16,700. It is likely that the Nifty may be making a significant low and a strong thrust on the upside.

Next week is expiry week. If Nifty manages to break above 16,400 in the early part of the week, the monthly expiry could be around 16,650-16,700. For a weekly expiry trader, this could be a good opportunity to be on the long side of the market.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

[ad_2]

Read More: More than 100 smallcaps gain 10-50% as market bounces back in volatile week