[ad_1]

Business confidence took a sharp hit as Omicron spread rapidly across the UK at the end of last year, according to a study by the Bank of England.

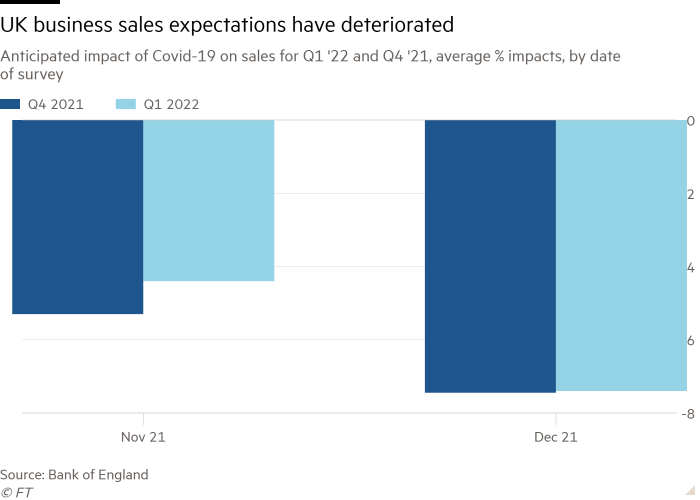

Sales in the first three months of 2022 are now expected to be 7.4 per cent lower than predicted due to the impact of the new coronavirus variant, the central bank’s survey of nearly 3,000 chief financial officers found.

Companies also expected the surge in infections to lead to a cut in investment of 10 per cent, while their plans for recruitment are likely to fall 4.4 per cent short, according to the BoE’s monthly decision maker panel survey.

The responses showed a marked deterioration across all measures tracked by the survey, with drops of up to 8 percentage points in expectations compared with November.

The survey, which was conducted between December 3 and 17, also found 63 per cent of businesses reporting it to be “much harder” than normal to recruit employees, with a further 23 per cent finding it “a little harder” to find staff.

A similar pessimistic view was evident for the final quarter of 2021, supporting mounting evidence that the UK economy took a significant hit in December from the surge in Covid-19 cases due to staff absences and a fall in consumption.

Gabriella Dickens, economist at Pantheon Macroeconomics, said the available data suggested “the emergence of the Omicron variant [had] weighed on consumer services expenditure over recent weeks”. She expected a 0.6 per cent drop in GDP in December and a further 0.3 per cent fall in January.

The BoE survey found that the hospitality and transport sectors were the most affected with both reporting an 11 per cent hit to sales expectations in the first quarter of this year because of Covid. The transport sector also reported a 35 per cent hit to its investment expectations over the same period.

Businesses reporting recruitment difficulties last month also experienced higher rates of staff absences, potentially adding to labour supply pressures. The share of workers who were unable to work due to factors including sickness, self-isolation and childcare, rose in December to 4 per cent, the highest level since the start of the pandemic.

The results chime with the final reading on Thursday of the IHS Markit/Cips services purchasing manager’s survey, which fell to 53.6 in December — from 58.5 the previous month — to its lowest level since February.

Tim Moore, economics director at IHS Markit, said the survey indicated “a severe loss of momentum for the UK economy . . . as many customer-facing businesses experienced a drop in demand due to escalating Covid-19 cases”.

The IHS survey similarly found transport and hospitality businesses were badly hit, as they overwhelmingly cited a sharp drop in activity due to tighter pandemic restrictions and cancelled events in the run-up to Christmas.

Amy Baker, hairdresser and owner of Wisbech-based beauty centre, said that “cancellations at the last minute, or no-shows, were rife during December. The moment Omicron struck, people stopped going out and so didn’t need to get a haircut or makeover.”

Despite the gloomy picture, Dickens said there was still a possibility that the economic performance in the early part of 2021 could surpass the gloomy expectations given early evidence that Omicron leads to milder illness than the previous Delta variant.

“We can’t rule out a rise in GDP in January if consumers feel more confident to risk contracting Covid-19, now that Christmas is out of the way and people know that Omicron is less likely to result in serious illness than Delta,” said Dickens.

[ad_2]

Read More: UK business confidence takes a sharp hit from Omicron